Community Calendar

Events for September 2024

2:00 pm to 4:00 pm

Fairfield Arts and Convention Center

Field of Dreams at Cinema Fairfield

September 1, 2024

2:00 pm · 4:00 pm

PG | 1989 ‧ Sport/Fantasy | 1h 47m

DOUBLE HEADER

Field of Dreams 7PM

When Iowa farmer Ray hears a mysterious voice one night in his cornfield saying “If you build it, he will come,” he feels the need to act. Despite taunts of lunacy, Ray builds a baseball diamond on his land, supported by his wife, Annie. Afterward, the ghosts of great players start emerging from the crops to play ball, led by “Shoeless” Joe Jackson. But, as Ray learns, this field of dreams is about much more than bringing former baseball greats out to play.

3:30 pm to 5:00 pm

FPL Meeting Room

LEGO Playtime @ FPL

104 W Adams AveFairfield, IA

Map to Event

September 2, 2024

3:30 pm · 5:00 pm

LEGO Playtime Date & Time: Every Monday afternoon from 3:30-5:00pm Location: FPL Meeting Room Join for unstructured playtime every Monday! If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

For More InformationContact: Fairfield Public Library

(641) 472-6551

circ@fairfield.lib.ia.us

Website

Next Level Leader

Fairfield, IASeptember 3, 2024 For More Information

Contact: Mendy McAdams

(641) 472-2111

Mendy@fairfieldiowa.com

Website

4:00 pm

Jefferson County Health Center- Conference Room C

Jefferson County Health Center Parkinson's Support Group

2000 S. Main St.Fairfield, IA

Map to Event

September 3, 2024

4:00 pm

Join JCHC Therapy Services for our Parkinson's Disease Support Group. We focus on learning, sharing experiences, and establishing connections in a welcoming, comforting environment. The Jefferson County Parkinson’s Support Group is a Community Group that meets once a month with support from JCHC and the Iowa Chapter of the American Parkinson’s Disease Association (APDA)- “Strength in Optimism. Hope in Progress." The purpose of the group is to learn by talking with others and sharing experiences, tips, ideas about living with PD or about being a care partner.

For More InformationContact: Michelle Boeding-Kreuter

(641) 469-4353

mboeding-kreuter@jchc.org

Website

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

September 4, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

5:00 pm to 10:00 pm

Family Supper Club Pop-Up at Due South

102 N 2nd StMap to Event

September 4, 2024

5:00 pm · 10:00 pm

We are launching a pop-up series that is bound to keep dining in Fairfield, fresh and fun!

Our weekly Brunch service is making an immediate jump to a once a month pop-up as part of the new series! This decision comes after months of wildly inconsistent turn out for a service that requires a considerable amount of prep and staff to execute. We love brunch and want to continue to offer it. The pop-up concept allows us to make it even more special and have more fun with our menu and offerings!

Brunch Pop-up: every second Sunday - starts September 8.

Oyster Bar Pop-up: monthly on Wednesdays, next one is August 21st!

Family Supper Club Pop-up: Monthly on Wednesdays, kicking off on September 4th

In the meantime, join us tonight for dinner, 5-9

6:00 pm to 7:00 pm

Behner Funeral Home

Coffee, Cookies, and Conversation

203 South Main StreetFairfield , IA

Map to Event

September 4, 2024

6:00 pm · 7:00 pm

Join us at Behner Funeral Home for Coffee, Cookies, and a Conversation about grief.

For More InformationContact: Rachel Brown

(641) 472-4116

rachel@behnerfh.com

Website

11:00 am

Fairfield Golf & Country Club

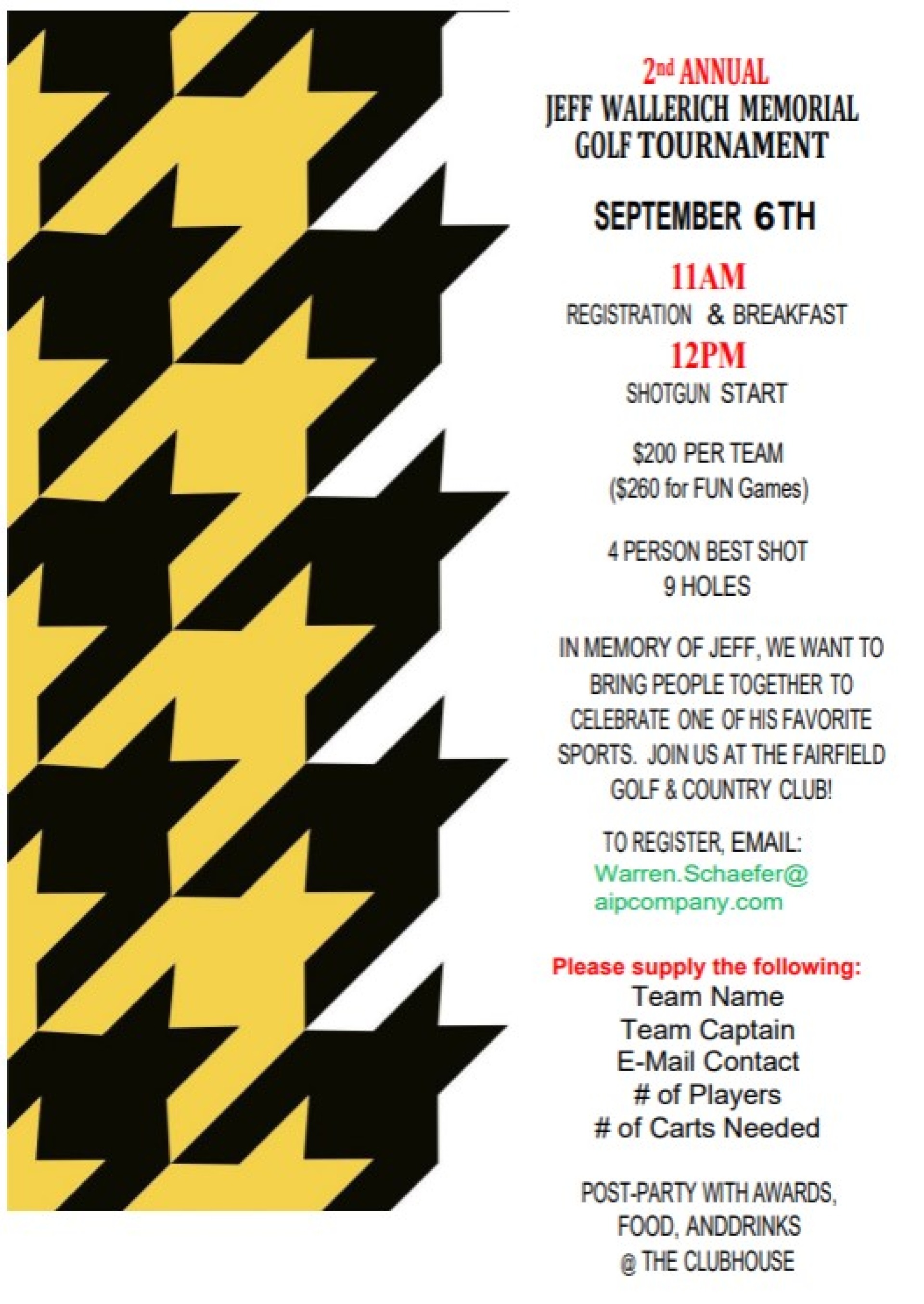

2nd Annual Jeff Wallerich Memorial Golf Tournament

909 E HarrisonMap to Event

September 6, 2024

11:00 am

4:00 pm to 7:00 pm

Fairfield Guest Houses

Business After Hours @ Fairfield Guest Houses

500 E Burlington AveFairfield, IA

Map to Event

September 6, 2024

4:00 pm · 7:00 pm

https://www.youtube.com/watch?v=WsQyMLOoIo4

https://www.youtube.com/watch?v=toW8y8dDdPw

OB Nelson

Youth Soccer & Flag Football Camp for K-6th

September 7, 2024

City of Fairfield Parks and Recreation Youth Soccer and Flag Football dates have been set for 2024!

Forms will be distributed to local schools the week of August 26th but take note: in order to guarantee that your participant gets the t-shirt size they need, participants need to be registered by Friday, August 30th. We know that's a tight timeline which is why REGISTRATION IS OPEN RIGHT NOW! Forms are available at the front desk but you don't even need to come in, call us weekdays between open and 4:00pm and we'll get you registered over the phone (641)472-6159

*additional 2.5% fee for credit card transactions, minimum fee of $1.95

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

September 7, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

10:00 am to 2:00 pm

Brunch Pop- Up at Due South

102 N 2nd StMap to Event

September 8, 2024

10:00 am · 2:00 pm

We are launching a pop-up series that is bound to keep dining in Fairfield, fresh and fun!

Our weekly Brunch service is making an immediate jump to a once a month pop-up as part of the new series! This decision comes after months of wildly inconsistent turn out for a service that requires a considerable amount of prep and staff to execute. We love brunch and want to continue to offer it. The pop-up concept allows us to make it even more special and have more fun with our menu and offerings!

Brunch Pop-up: every second Sunday - starts September 8.

Oyster Bar Pop-up: monthly on Wednesdays, next one is August 21st!

Family Supper Club Pop-up: Monthly on Wednesdays, kicking off on September 4th

In the meantime, join us tonight for dinner, 5-9

4:00 pm to 7:00 pm

Picture Perfect Salon & Spa

10 Year Anniversarry Celebration @ Picture Perfect

200 West BurlingtonMap to Event

September 8, 2024

4:00 pm · 7:00 pm

3:30 pm to 5:00 pm

FPL Meeting Room

LEGO Playtime @ FPL

104 W Adams AveFairfield, IA

Map to Event

September 9, 2024

3:30 pm · 5:00 pm

LEGO Playtime Date & Time: Every Monday afternoon from 3:30-5:00pm Location: FPL Meeting Room Join for unstructured playtime every Monday! If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

For More InformationContact: Fairfield Public Library

(641) 472-6551

circ@fairfield.lib.ia.us

Website

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

September 11, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

7:00 pm to 10:00 pm

Noble House

Music with Adam Sinclair

115 North MainFairfield, IA

Map to Event

September 11, 2024

7:00 pm · 10:00 pm

We are having music once a month on every second Wednesday at 7pm with Adam Sinclair. ![]() Come enjoy some tunes while sipping on our house drinks.

Come enjoy some tunes while sipping on our house drinks. ![]()

(641) 472-2111

chamber@fairfieldiowa.com

2:00 pm to 12:00 pm

Libertyville, IA

Symmetry Music & Arts Festival

September 12, 2024

2:00 pm · 12:00 pm For More Information

Contact: Donald Revolinski

(641) 919-7071

donald@vibedigitalagency.com

Website

4:00 pm to 6:00 am

Addington Place of Fairfield

2:00 pm to 12:00 pm

Libertyville, IA

Symmetry Music & Arts Festival

September 12, 2024

2:00 pm · 12:00 pm For More Information

Contact: Donald Revolinski

(641) 919-7071

donald@vibedigitalagency.com

Website

4:00 pm to 7:00 pm

Maasdam Barns

5:00 pm

Chautauqua Park

FPL Family Bike Ride

Fairfield, IASeptember 13, 2024

5:00 pm

FPL Family Bike Ride Upcoming Dates: May 17th, June 14th, July 12th, Aug. 9th, Sept. 13th, and Oct. 11th Location: Chautauqua Park Audience: All Ages Join FPL volunteer Wayne Ades for a Family Bike Ride the second Friday of each month at Chautauqua Park. Meet at the entrance to the trail at Chautauqua at 5:00 PM and the ride will begin at 5:15. All participants age 10 and under should be accompanied by an adult. If you need disability-related accommodations in order to participate in this event, please contact the library. For all other questions, contact the FPL Front Desk at at 641-472-6551, Ext. 2.

For More InformationContact: Front Desk

(641) 472-6551

circ@fairfield.lib.ia.us

Website

OB Nelson

Youth Soccer & Flag Football Camp for K-6th

September 14, 2024

City of Fairfield Parks and Recreation Youth Soccer and Flag Football dates have been set for 2024!

Forms will be distributed to local schools the week of August 26th but take note: in order to guarantee that your participant gets the t-shirt size they need, participants need to be registered by Friday, August 30th. We know that's a tight timeline which is why REGISTRATION IS OPEN RIGHT NOW! Forms are available at the front desk but you don't even need to come in, call us weekdays between open and 4:00pm and we'll get you registered over the phone (641)472-6159

*additional 2.5% fee for credit card transactions, minimum fee of $1.95

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

September 14, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

2:00 pm to 12:00 pm

Libertyville, IA

Symmetry Music & Arts Festival

September 12, 2024

2:00 pm · 12:00 pm For More Information

Contact: Donald Revolinski

(641) 919-7071

donald@vibedigitalagency.com

Website

2:00 pm to 12:00 pm

Libertyville, IA

Symmetry Music & Arts Festival

September 12, 2024

2:00 pm · 12:00 pm For More Information

Contact: Donald Revolinski

(641) 919-7071

donald@vibedigitalagency.com

Website

Cedar Valley Winery

Cedar Valley Winery Lodge Now Open for Bookings!

2034 Dewberry AvenueBatavia, IA

Map to Event

September 16, 2024

Cedar Valley Winery

Lodge

Now Open for Bookings!

This spacious, modern B&B is just waiting to accommodate your visit. Be it a hunting trip or just a getaway, this 3 bedroomed, 12 berth lodge boasts full amenities. From wifi to laundry facilities. Just arrive and this gem nesteled between luscious vineyards with a panorama to boot, will do the rest! Whether family vacay or hunting weekend. This venue awaits!

For bookings call 641-662-2800

2034 Dewberry Ave, Batavia

For More InformationContact: Cedar Valley Winery

(641) 662-2800

Website

3:30 pm to 5:00 pm

FPL Meeting Room

LEGO Playtime @ FPL

104 W Adams AveFairfield, IA

Map to Event

September 16, 2024

3:30 pm · 5:00 pm

LEGO Playtime Date & Time: Every Monday afternoon from 3:30-5:00pm Location: FPL Meeting Room Join for unstructured playtime every Monday! If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

For More InformationContact: Fairfield Public Library

(641) 472-6551

circ@fairfield.lib.ia.us

Website

9:00 am to 10:00 am

Virtual - Zoom

Virtual Coffee Break - Be Prepared: Bank Edition

15330 Truman StreetOttumwa, IA

Map to Event

September 18, 2024

9:00 am · 10:00 am

Explore banking services and credit unions, delve into various loan options, and learn the differences between loans and lines of credit. Gain practical insights on preparation steps before meetings and key questions to ask.

For More InformationContact: Marissa Long

(641) 683-5312

marissa.long@indianhills.edu

Website

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

September 18, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

4:00 pm to 5:30 pm

Fairfield Arts and Convention Center

6:00 pm to 9:30 pm

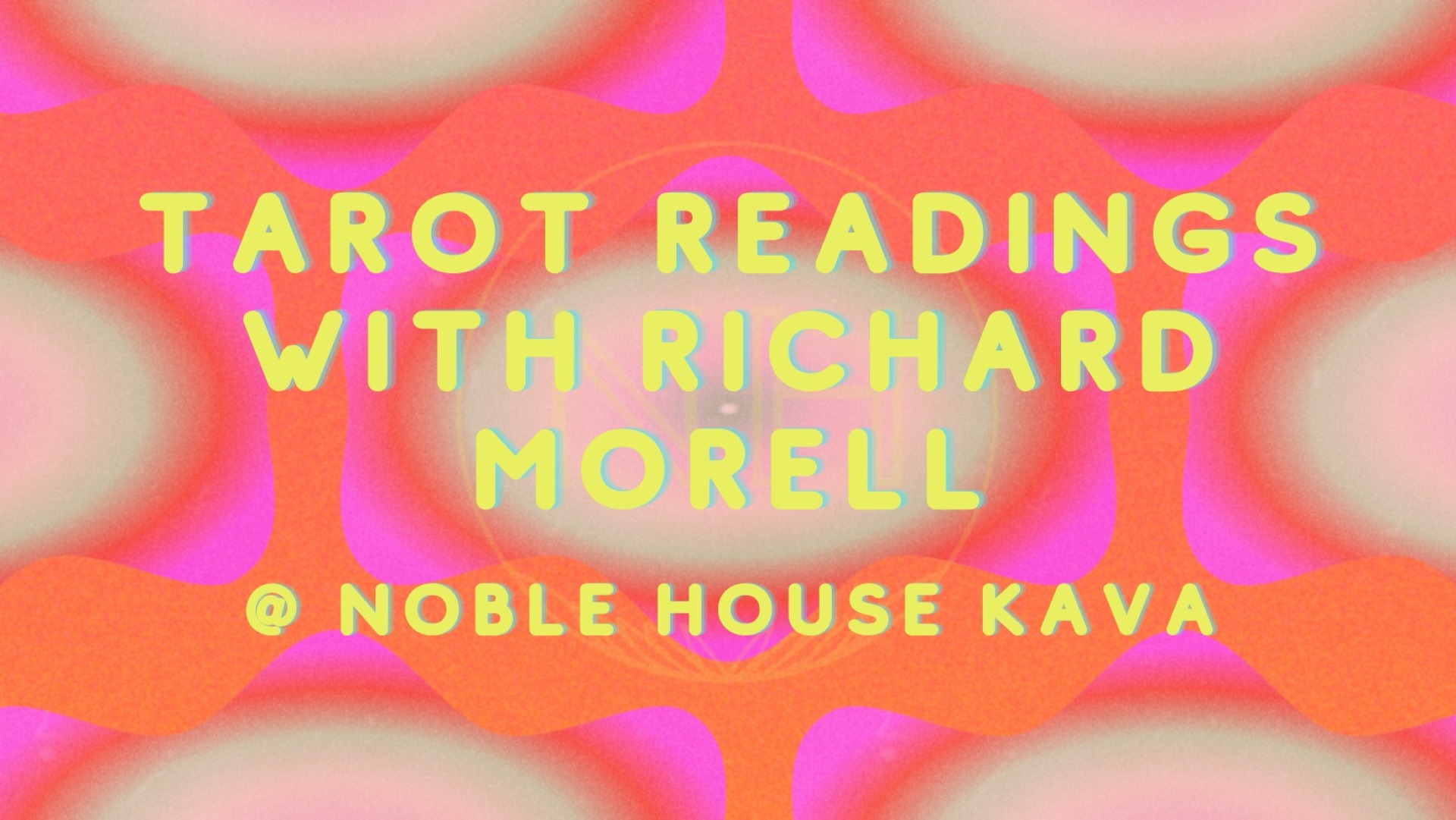

Noble House

Richard Morell Tarot Readings

115 N MainFairfield, IA

Map to Event

September 18, 2024

6:00 pm · 9:30 pm

Richard Morell will be doing Tarot Readings Every 3rd Wednesday at 5 pm at Noble House Kava. He has been reading for 40 years.

Pricing: $25 for a full Celtic Cross, $15 for a 5-card reading.

Bio for Tarot Readings

Despite his parents having forbidden his acquiring a tarot deck, Richard Morell got his first Rider-Waite pack 41 years ago, when he was a college freshman. He has been studying the cards and reading for people ever since. Richard began to read professionally in 2006 when he hung out his shingle in Albany, New York.

For the last 10 years, Richard has managed the Advisors Page at astrologyanswers.com. When he lived in Laramie, Wyoming, Richard could be counted on to read for the locals every Saturday at the Herb House. He is also a gifted Western astrologer–having been reading charts since age 7–as well as a capable numerologist.

5:30 pm to 7:30 am

Cedar Valley Winery

Wine with YOUR Lawmakers

2034 Dewberry AvenueBatavia, IA

Map to Event

September 20, 2024

5:30 pm · 7:30 am

Mingle with a wide range of Jefferson Lawmakers, government representatives and public servants at this free event, sponsored by the new Jefferson County Republican Women's Club. Everyone is invited to enjoy the winery's scenic sunset, cash bar, winery tours, plus yard games, door prizes and good conversation.

For More InformationContact: Mary Jones

(319) 540-4551

Mjbrambles@gmail.com

Website

6:00 am to 1:00 pm

On the Square

Kiwanis Kid's Day: Building For The Future

September 21, 2024

6:00 am · 1:00 pm

2024 Fairfield Kiwanis Kids’ Day: Building For The Future

Pancake Tent on the square

6 am to 1 pm

Free Kids Activities on The Square: Pony Rides, Clown, Pedal -Pull, Face-Painting, Bouncy House

"Building for the Future" Parade

Begins at 10:00 am

Floats – Bands – Shrine clubs – Horses – Tractors - Vintage Cars

(Line up @ Fairfield High School Parking Lot by 9:30am)

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

September 21, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

10:00 am to 2:00 pm

Brunch Pop- Up at Due South

102 N 2nd StMap to Event

September 22, 2024

10:00 am · 2:00 pm

We are launching a pop-up series that is bound to keep dining in Fairfield, fresh and fun!

Our weekly Brunch service is making an immediate jump to a once a month pop-up as part of the new series! This decision comes after months of wildly inconsistent turn out for a service that requires a considerable amount of prep and staff to execute. We love brunch and want to continue to offer it. The pop-up concept allows us to make it even more special and have more fun with our menu and offerings!

Brunch Pop-up: every second Sunday - starts September 8.

Oyster Bar Pop-up: monthly on Wednesdays, next one is August 21st!

Family Supper Club Pop-up: Monthly on Wednesdays, kicking off on September 4th

In the meantime, join us tonight for dinner, 5-9

3:30 pm to 5:00 pm

FPL Meeting Room

LEGO Playtime @ FPL

104 W Adams AveFairfield, IA

Map to Event

September 23, 2024

3:30 pm · 5:00 pm

LEGO Playtime Date & Time: Every Monday afternoon from 3:30-5:00pm Location: FPL Meeting Room Join for unstructured playtime every Monday! If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

For More InformationContact: Fairfield Public Library

(641) 472-6551

circ@fairfield.lib.ia.us

Website

3:00 pm to 6:00 pm

On the Square

Summer Outdoor Farmer's Market

September 25, 2024

3:00 pm · 6:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

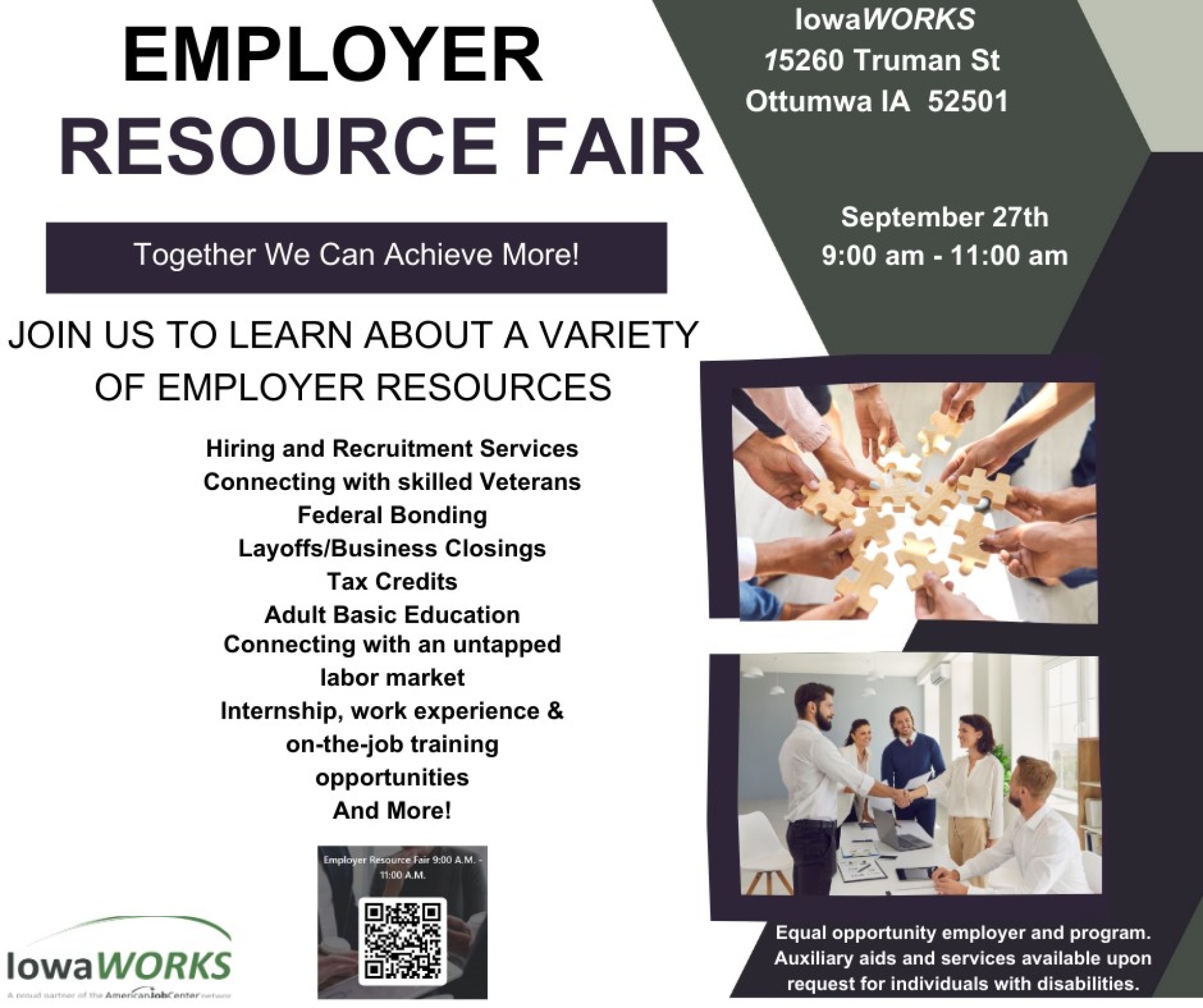

9:00 am to 11:00 am

September 27, 2024

9:00 am · 11:00 am

In recognition of Workforce Development month, we wanted to provide a fair for employers only! We appreciate all you do for us and we want to take this opportunity to give information back to you.

The event will be held at the Ottumwa IowaWORKS office on Friday, September 27th from 9:00 am- 11:00 am. At 9:00 we will do an introduction of the presenters and they will give an overview of their services/resources for employers. After they are finished, you can go from table to table to ask more detailed questions or collect information. If you are not able to make it at 9:00, we still welcome you to come when you can.

The flyer is attached with the QR code or here is the link to register:

https://forms.office.com/g/KURGSE7TQW

For More InformationWebsite

4:30 pm to 6:30 pm

Zillman’s Hickory Hills

Monarch Tagging

2437 Glasgow RoadFairfield, IA

Map to Event

September 27, 2024

4:30 pm · 6:30 pm

For the past several years high numbers of migrating monarchs have been found at Zillman’s Hickory Hills. Join us for a fun evening of catching, tagging and releasing monarch butterflies as they begin their annual migration.

Monarch butterflies cannot survive our cold Iowa winters, instead they travel up to 3,000 miles south to forests high in the mountains of Mexico. Monarchs will stop to nectar along the way which is to our advantage. Not only do they help to pollinate our plants, but it also gives us the opportunity to see them. We will be assisting with monarch research by catching the butterflies, placing a small tag on their wing, recording their information and releasing them to continue on their long journey. These tags help researchers to learn about the migration of the monarch.

Zillman’s Hickory Hills is located at 2437 Glasgow Rd. Pre-registration is not required. Nets and tags will be provided but please wear long pants and closed toed shoes.

Naturalist@JeffersonCountyConservation.com

OB Nelson

Youth Soccer & Flag Football Camp for K-6th

September 28, 2024

City of Fairfield Parks and Recreation Youth Soccer and Flag Football dates have been set for 2024!

Forms will be distributed to local schools the week of August 26th but take note: in order to guarantee that your participant gets the t-shirt size they need, participants need to be registered by Friday, August 30th. We know that's a tight timeline which is why REGISTRATION IS OPEN RIGHT NOW! Forms are available at the front desk but you don't even need to come in, call us weekdays between open and 4:00pm and we'll get you registered over the phone (641)472-6159

*additional 2.5% fee for credit card transactions, minimum fee of $1.95

8:00 am to 1:00 pm

Howard Park

Summer Outdoor Farmer's Market

September 28, 2024

8:00 am · 1:00 pm

Summer Outdoor Market

Now through October 30

Wednesdays on the Square 3:00-6:00pm

Saturdays at Howard Park 8:00am- 1:00pm

8:00 am to 1:00 pm

Howard Park

Farmers Market

East Grimes Ave and North Main StFairfield, IA

Map to Event

September 28, 2024

8:00 am · 1:00 pm

Nothing beats fresh grown produce and if that’s your thing, then head to the Fairfield Farmers market! Fairfield’s Farmers Market is a popular and festive summer event where fresh local produce catches your eye in every direction you look. All the items sold at the Farmers market are home grown and produced right here in Jefferson County. Alongside the array of fruits, vegetables, and baked goods, local vendors provide a vast selection of handmade arts and crafts Located in Howard Park, which is close by the new Fairfield Arts and Convention Center, the Farmers Market begins the first Saturday of May and continues until the last Saturday of October. The park offers a well-equipped playground for the kids to run around while you handpick your goodies. The Farmers Market is open Wednesdays and Saturdays May through October

10:00 am to 3:00 pm

Fairfield Arts and Convention Center

Fall Craft & Vendor Show

200 N. Main StreetFairfield, IA

Map to Event

September 28, 2024

10:00 am · 3:00 pm

55. Crafters and vendors for this event. Chillin N Grillin BBQ I’ll be at this event from 10 to 3!

For More InformationContact: Fairfield Arts and Convention Center

10:00 am to 12:00 pm

DGM Fairfield, IA Pottery Studio

Come Play with Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd StreetFairfield, IA

Map to Event

September 28, 2024

10:00 am · 12:00 pm

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance – build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe — for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met – refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE – See attached photo for exact location

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school’s ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

11:00 am to 2:00 pm

Hy-Vee

Hy-Vee Block Party

September 28, 2024

11:00 am · 2:00 pm

Hey Fairfield Friends…we are having our 8th annual HyVee Friends Block Party on Sept. 28, 2024, set up starts at 10. Event is 11-2. We have 45+ businesses, organizations, and vendors participating with us this year and we are excited to to welcome all the new participants this year, there are so many. We will also have DeLovely’s Donuts, Fire Dept. Sheriff’s Dept, a live DJ and music, kids dance party, we have the Kids and Adults dance contests with prizes, we will have our grill going with everyone’s favorite foods, plus all of our businesses, organizations, and vendors will be on hand to visit with the whole community…come out and see Fairfield’s finest…if you’d like to participate please msg me, or call me at the store 641-472-4119. We have limited space available so let us know before Aug. 31, 2024…see everyone on Sept. 28, 2024 at 11-2. We will have a list of our participants closer to our event date.

1:00 pm to 3:00 pm

DGM - Fairfield, IA Pottery Studio

Come Play With Clay: Beginning Wheel Throwing with Jessi Tucci

400 N 2nd StreetFairfield, IA

Map to Event

September 28, 2024

1:00 pm · 3:00 pm

All Skill Levels are Welcome!

Already attended a Beginning Wheel Class with Jessi? Sign-up and come out again! Continue to practice your skills, and get expert feedback guidance – build muscle memory!!

This workshop is about the experience of learning to work with a pottery wheel. It is a great way to experience firsthand working with clay.

Watch demonstrations from Jessi Tucci, ask questions and then try your own hand at throwing several pieces.

This workshop will expose you to: how to center clay on the wheel, and how to pull a small form (cups or bowls). This class is about the process of working with clay on the wheel rather than a specific outcome.

Each participant will complete at least 1-2 cups or bowls.

If desired the Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe — for pick-up at a later date.

Instructor, Materials, Supplies, Tools and Equipment are included.

What to wear: Students must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation policy: DGM reserves the right to cancel sessions due to the minimum enrollment not being met – refunds will be issued within 10 days of event cancellation. Participants may not cancel their session for a refund. Tickets are transferable with advance notice.

Location

Deep Green Machine, Inc

400 North 2nd Street Fairfield, Iowa 52556

Telephone: 660 223 3691 Email: frank@deepgreenmachine.com

Located BEHIND TACO DREAMS/THE BAKEHOUSE – See attached photo for exact location

About Instructor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school’s ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

3:30 pm to 11:00 pm

MIU ROAP Farm

Harvest Festival

1917 Hwy 1Fairfield, IA

Map to Event

September 28, 2024

3:30 pm · 11:00 pm

This is a chance for the community to come together in the spirit of honoring the land that nourishes us and bestows great abundance

We are currently looking for volunteers and vendors. We would love for you to be a part of our team and join in on the fun!

There’s lots of different tasks to do and we will do our best to cater to your interests and skills.

Plus you get a tie-dye shirt and pizza party ;))

More details on the event to come closer to the date

4:00 pm

DGM: Fairfield, IA Pottery Studio

Open Pottery Studio

400 N 2nd StreetFairfield, IA

Map to Event

September 28, 2024

4:00 pm

Open Pottery Studio is offered to individuals who have attended private lessons, classes or have prior pottery experience. We cannot provide instruction during open studio hours - only minimal tips and tricks or comments. If you need assistance on the wheel you will have to take a workshop or schedule a private lesson.

(2) Hour Open studio session is $25 and includes approximately 4 pounds of clay. Prepping your clay, setting up & clean up is part of the wheel time. Materials, Supplies, Tools and Equipment are included.

Additional Split Rock Stoneware Cone 6 Clay is sold for $2.00 per pound.

Bisque and Glaze Firing is $8.00 (cash or check payable to Deep Green Machine) for a “coffee cup sized piece.” Volunteer Studio Team will glaze and fire your creation to make it food-microwave-dishwasher safe. Completed works are typically returned in 4-8 weeks depending on kiln availability.

Studio volunteers will trim and glaze your work.

What to wear: Participants must wear closed toed shoes for safety and ceramic wheel students should wear clothes they do not mind getting messy.

PLEASE BE ON TIME

Cancellation Policy DGM reserves the right to cancel sessions due to the minimum enrollment not being met - refunds will be issued within 10 days of event cancellation. Participants *MAY NOT* cancel their session for a refund. Tickets *ARE* transferable with advance notice.

The DGM Fairfield, IA Pottery Studio is located at 400 N 2nd Street, Fairfield, IA 52556 -- Between: The BakeHouse, Taco Dreams Fairfield and the Railroad Tracks.

About Studio Monitor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

About Studio Monitor Jessi Tucci

Jessi Tucci has been working with clay for 15 years.

She had found a wheel in the back of her high school's ceramic room and begged her teacher to use it. With too many students in one class she had to stay after school hours to play around on the wheel.

It was an immediate addiction.

Restless after high school Jessi moved around the country and every semester, at every college Jessi took a ceramic class, even after she had way too many art credits. Functional pottery is her passion.

7:00 pm to 8:15 pm

Sondheim Center for Performing Arts

One Hand Clapping: Paul McCartney & Wings

200 N. Main StreetFairfield, IA

Map to Event

September 28, 2024

7:00 pm · 8:15 pm

Directed by David Litchfield, this film captured a moment when Paul McCartney and Wings had found and defined their signature sound. Filmed over four days at Abbey Road Studios in August 1974, the film provides an insight into the inner workings of the band as they work and play together in the studio. Including performances of tracks from Wings masterpiece Band on the Run (released in 1973), intimate footage of the band hanging out in the studio, combined with audio interview snippets, the film also includes previously unreleased in full footage of a solo acoustic performance by Paul called The Backyard Sessions.

In addition to the film, this screening event includes an introduction by Paul McCartney recorded exclusively for movie theatre audiences as well as unseen Polaroids of the band. Learn more at onehandclapping.film/home.

For More Informationinfo@fairfieldacc.com

9:00 am to 10:00 am

Vitalbody Pilates & Movement Studio

Vinyasa Yoga; Strength & Flow

121 W Broadway AveFairfield, IA

Map to Event

September 29, 2024

9:00 am · 10:00 am

A Vinyasa flow yoga based class, but with added core and strength challenges. Make this class your own! With opportunities to play to your edge with optional vinyasas, or explore a resting pose of your choice.

As we build strength and flexibility in this class you are invited to explore an arm balance, an inversion or any other pose that competes your practice, whilst the wonderful Mary provides guidance in developing your strength & progressing through levels in balance and technique. This is a constantly moving, flowing class sure to help you feel rejuvenated, reset and ready for the week ahead!

7:00 pm to 8:15 pm

Sondheim Center for Performing Arts

One Hand Clapping: Paul McCartney & Wings

200 N. Main StreetFairfield, IA

Map to Event

September 29, 2024

7:00 pm · 8:15 pm

Directed by David Litchfield, this film captured a moment when Paul McCartney and Wings had found and defined their signature sound. Filmed over four days at Abbey Road Studios in August 1974, the film provides an insight into the inner workings of the band as they work and play together in the studio. Including performances of tracks from Wings masterpiece Band on the Run (released in 1973), intimate footage of the band hanging out in the studio, combined with audio interview snippets, the film also includes previously unreleased in full footage of a solo acoustic performance by Paul called The Backyard Sessions.

In addition to the film, this screening event includes an introduction by Paul McCartney recorded exclusively for movie theatre audiences as well as unseen Polaroids of the band. Learn more at onehandclapping.film/home.

For More Informationinfo@fairfieldacc.com

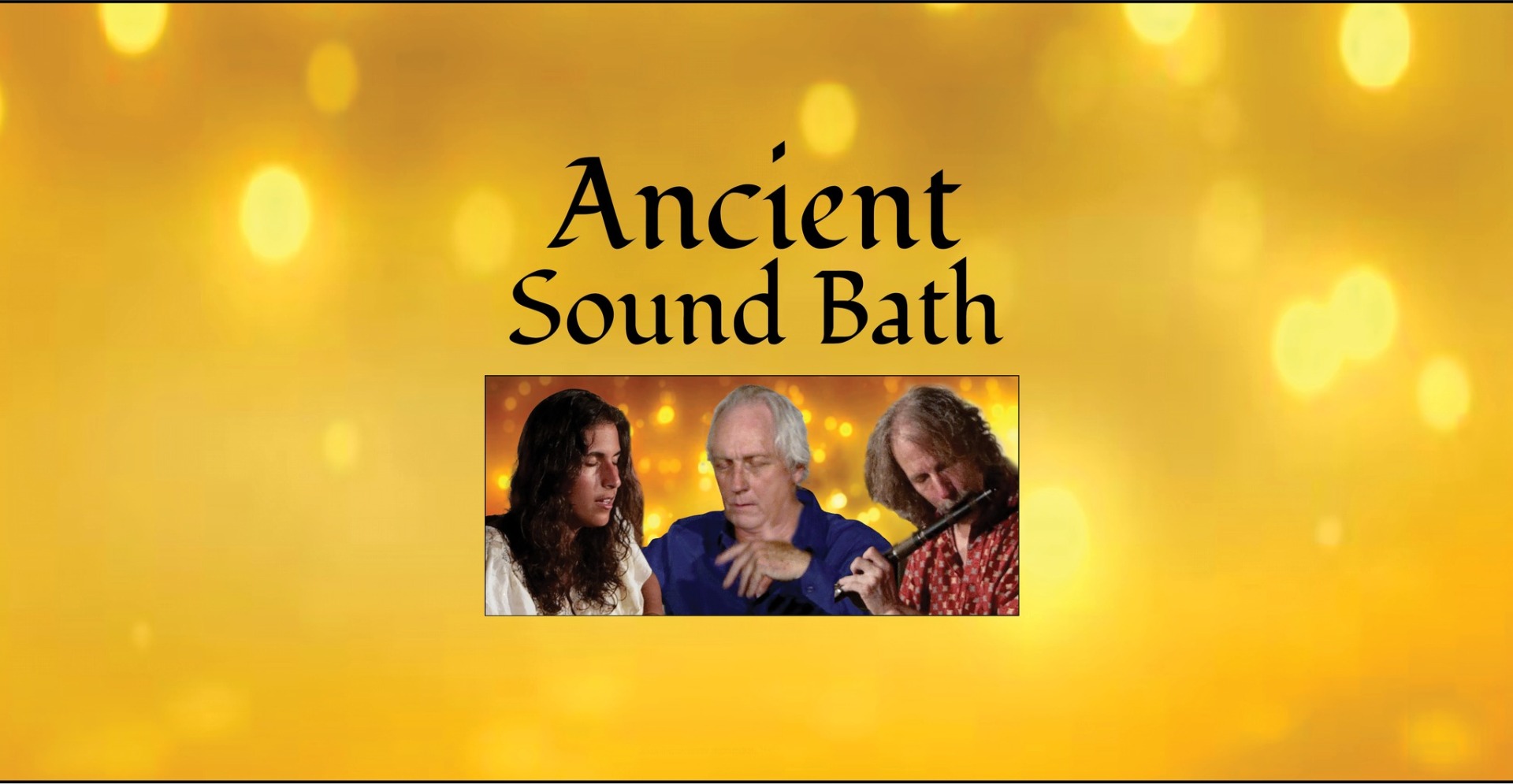

7:30 pm

Golden Magnolia Sanctuary

Ancient Sound Bath

200 South MainFairfield, IA

Map to Event

September 29, 2024

7:30 pm

Ancient Sound Bath

Thursday August 29, 7:30 pm | Golden Magnolia Sanctuary

Immerse yourself in the soothing sounds of tambouras and swara mandala harps, accompanying Tim Britton on flute and vocalists Muna Askar and Werner Elmker. The interplay of three swara mandala harps played by Joetta Lashway, Narayani Om and Luky Boender and three tambouras played by Keefe Lashway, Muna Askar and Werner Elmker creates a rich tapestry of harmonics that in itself will transport you to inner peace. On this ancient resonant bed, the improvised melodies will draw you into greater and greater depths of silence.

Pay What You May.

Suggested donation: $20

All donations go to Golden Magnolia Sanctuary

(former Presbyterian Church, 200 South Main Street)

(641) 472-2111

chamber@fairfieldiowa.com

3:30 pm to 5:00 pm

FPL Meeting Room

LEGO Playtime @ FPL

104 W Adams AveFairfield, IA

Map to Event

September 30, 2024

3:30 pm · 5:00 pm

LEGO Playtime Date & Time: Every Monday afternoon from 3:30-5:00pm Location: FPL Meeting Room Join for unstructured playtime every Monday! If you need disability-related accommodations in order to participate in this event, please contact the FPL Front Desk at at 641-472-6551, Ext. 1.

For More InformationContact: Fairfield Public Library

(641) 472-6551

circ@fairfield.lib.ia.us

Website

7:00 pm to 8:45 pm

Sondheim Center for Performing Arts

Widow Clicquot

200 N. Main StreetFairfield, IA

Map to Event

September 30, 2024

7:00 pm · 8:45 pm

Widow Clicquot is based on the true story of the “Grande Dame of Champagne,” Barbe-Nicole Ponsardin (1777–1866) who, at the age of 20, became Madame Clicquot after marrying the scion of a winemaking family. Though their marriage was arranged, a timeless love blossomed between Barbe-Nicole (Haley Bennett) and her unconventional, erratic husband, François (Tom Sturridge). After her husband’s untimely death, Barbe-Nicole flouts convention by assuming the reins of the fledgling wine business they had nurtured together. Steering the company through dizzying political and financial reversals, she defies her critics and revolutionizes the champagne industry to become one of the world’s first great entrepreneurs.

Critics are calling it a dramatic, romantic, elevated “girl boss” story that effervesces. A regional exclusive screening!

“Centering around Haley Bennett’s sparkling performance, Widow Clicquot is a visually impressive tale of resilience that leaves a pleasing aftertaste on the palette.”

~ Rotten Tomatoes

For More Informationinfo@fairfieldacc.com

Our Sponsors

Special thanks to these members for their support of the Fairfield Chamber.

Submit an Event

Are you hosting an event that is open to the public and held in Fairfield or Jefferson County? Use our online form to submit event details to the Chamber to review for inclusion on our calendar.

More Calendars

School District Calendars

- Cardinal Community School District

- Fairfield Community School District

- Maharishi School

- Pekin Community School District

- Van Buren Community School District

Community Calendars